People often aspire to make more money. Obtaining a higher education and getting a pay increase at work are just a couple of the ways to gain a higher income. But making more money does not automatically equate having more money. To keep more of your earnings, create a personal budget; tracking your expenses – which also makes it easier to save some of your earnings consistently.

The list of wealthy people who have filed for personal bankruptcy, or whose companies have filed for bankruptcy include some well known names.

Roy O. Disney, who co-founded Walt Disney Production, one of the leading movie production companies in the world, filed for bankruptcy, in 1923 (Biography.com).

And former heavyweight boxing champion, Mike Tyson, who earned a mind-boggling $400 million over his 20 year career, filed for bankruptcy in 2003, according to the New York Times.

But not only wealthy people file bankruptcies. The total number of bankruptcy filings in the US for the period ending June 30, 2017, was 796,037 (uscourts.gov).

Regardless of the size of ones earnings, creating a personal budget, is an ideal way to track ones expenses, making it easier to avoid spending more than is earned, and creating the chance to save some of ones earnings consistently.

Tiana Cano, 19, Child Development Major at San Diego Mesa College, said she established a budget to save for a car at the beginning of the school year. “I had a set goal to save $3,000,” she said. Cano said further, that each week she saved half of her paycheck towards her goal of buying a car, and when she was not able to save half of her paycheck, she saved $5.

“Its kinda hard including other expenses in my budget,” Cano said. Saying further with a smile, “I want to spend my money … but i’ll save if I want to go out with my friends, or go to the movies.”

Creating a personal budget may seem tedious but time spent identifying your income and expenses, the first steps to developing a personal budget, is time spent developing the in-depth knowledge of your finances to wisely manage your money.

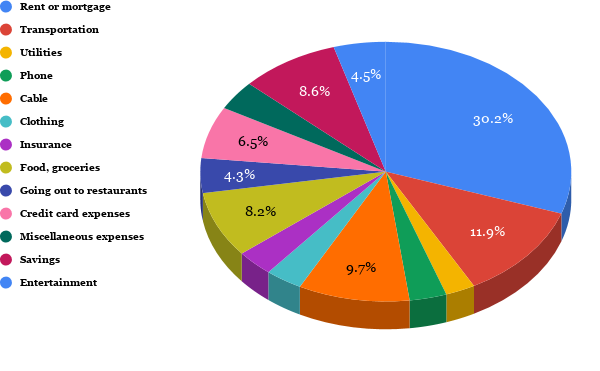

After identifying your income, your list of expenses may include:

Monthly Income $2,000

Rent or mortgage $700

Transportation, $275

Utilities, $60

Phone, $75

Cable $75

Clothing $225

Insurance $75

Food, groceries $190

Going out to restaurants $100

Credit card expenses $150

Miscellaneous expenses $85

Savings $200

Entertainment $105

Less total expenses $2,315

Monthly loss $315

Your list of expenses is a critical part of your budget because seeing your expenses on paper, gives you the knowledge of where expenses can be adjusted. For instance, one less restaurant meal may allow more money for an upcoming trip to a concert.

Monae Route, 17, Biology Major at Mesa, is saving for a computer, and helps out her grandma, earning a little extra money to accomplish this goal. “Every week I put a certain amount of money towards savings and I keep a certain amount of (my money),” she said. ” I am far from my goal, but getting there.”

An in-depth knowledge of your expenses puts you in control, says Gail Vaz-Oxlade, author of Easy Money. “You look at your budget and decide you can use some money from your “entertainment” category. You can also take some money from “clothes” and a little from “groceries.” You are consciously deciding how you will spend your money,” she wrote.

After identifying personal income and expenses, you now have accurate knowledge to decide whether you are spending more than you make.

For instance, since your monthly income is $2,000 and your expenses add up to $2,315, you have a monthly loss of $315. This accurate information gives you the knowledge to select the categories among your expenses where you can spend less to balance your budget, such as expenses for clothing, or going to restaurants.

If you have determined you are spending more than you are earning, another option would be to find a part time job. Options may include tutoring a student, picking up an extra shift at work, or becoming a dog walker.

Vaz-Oxlade has written a second book, Debt-Free Forever, in which she identifies a tool called a Life Pie, which she wrote “is useful for seeing how well balanced your budget is and where you may be overcommitting your resources.”

According to Vaz-Oxlade’s Life Pie, 35 percent of your money should be spent on housing, 15 percent on transportation, 25 percent on life, 15 percent on debt repayment, and 10 percent on savings.