A good FICO score, will allow you to get better interest rates – and encourage businesses to fight to conduct business with you – when making financial decisions such as, renting an apartment, buying a car, or paying for a light bill for your new apartment.

But if your credit score is poor, don’t be discouraged, because you can take steps to improve your credit score.

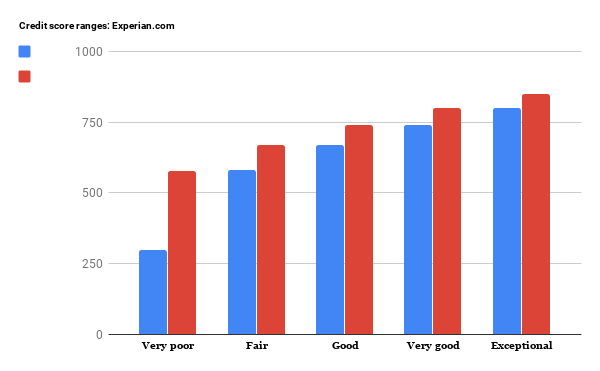

Your FICO (Fair Isaac Corporation), is a three-digit number which can range between 300 to 850, and answers a central question regarding financial transactions: whether you are a trusted person with whom a company would want to conduct business.

According to author Gail Vaz-Oxlade, Debt-Free Forever: Take Control of your Money and your life, “your credit score not only affects your ability to get credit, it affects the interest rate you will pay if you do,” she wrote.

“The better your score, the lower your risk to a lender (or the more profitable you are), and the lower the interest rate you’ll have to pay.”

CreditKarma.com, provides free credit reports, writes that your credit score is made up of percentages in the following areas: your payment history (35 percent), amount owed (30 percent), length of credit history (15 percent), mix of credit (10 percent) and new credit inquiries (10 percent).

For instance, suppose you have decided to rent an apartment and search around town, finding a nice place you would like to rent.

The landlord might like you and want to rent to you. However, they must first answer questions such as, whether you pay your bills on time, and whether given your existing debt, you have enough disposable income to afford to pay for that new apartment.

After completing the application for the apartment, the landlord will seek to answer the questions above by running a credit check.

Personal information from your completed rental application, such as your name, social security number and driver’s license number, will be used to obtain your credit, or FICO score from one of the credit reporting agencies.

If your credit is good, and you can afford to pay for that new apartment, you will likely be rewarded with that new apartment.

But it you have poor credit, do not lose hope, there are things you can do to improve your credit score.

According to Experian.com, you can take the following steps to improve your credit score: Minimize outstanding debt, avoid overextending yourself, and refrain from applying for credit needlessly

Other tips to improve your credit score according to Experian include: Avoid using unused credit accounts, only apply for new credit when necessary, check your credit report for inaccuracies and guard against identity theft my monitoring all your credit accounts.

You can get better interest rates and get businesses to be eager to conduct business with you, by taking steps to improve your FICO score.